* The wonderful Open City Apps has a new local economic dashboard, How's Business?

* Worth keeping in mind when you see employment and other demographic data: "There are more people in U.S. prisons than are in the country’s active-duty military. That much is well known. What’s less known is that people who are incarcerated are excluded from most surveys by U.S. statistical agencies. Since young, black men are disproportionately likely to be in jail or prison, the exclusion of penal institutions from the statistics makes the jobs situation of young, black men look better than it really is."

* Bloomberg surveyed a bunch of economists to ask: how much will the Institute for Supply Management-Chicago's business barometer fall? Survey says: slight slowing from 53 to 52.8. The ISM says: 49.7, actual contraction as opposed to a slowing of growth. It's not just us: "Uncertainties surrounding domestic fiscal policy and weakening economies in Europe and China may prevent companies from adding to headcount and ramping up production."

Overall, not a good report: "Among the Business Activity measures, five of seven posted declines as New Orders fell below 50 and Order Backlogs contracted for the fourth of the past five months. Prices Paid showed the biggest gain in nearly two years and Supplier Deliveries moved back above 50." If it makes you feel better or worse, Chicago Fed director Charles Evans's informal survey of CEOs suggests that America is currently the dimly flickering city on the global economic hill:

I regularly talk to a large number of chief executive officers (CEOs) about business conditions. Many of these executives run big firms with an international presence. Throughout the summer, they increasingly pointed to the U.S. as the bright spot in the global economy. Their comments, however, were not a testament to the U.S. recovery, but an indication that global economic activity was weakening — first in Europe and later elsewhere around the world. In addition, at home, we could face substantially more restrictive fiscal conditions if federal budget negotiations fail to resolve the issues surrounding the so-called fiscal cliff. And for both the global situation and the U.S. fiscal cliff, there is a lot of uncertainty over what the eventual outcomes will be.

* The volk feel differently: they're less confident about how things are now, but more confident about how things will be six months from now. Stabilization of gas and housing prices is credited, but most people also don't have to sell stuff to Europe.

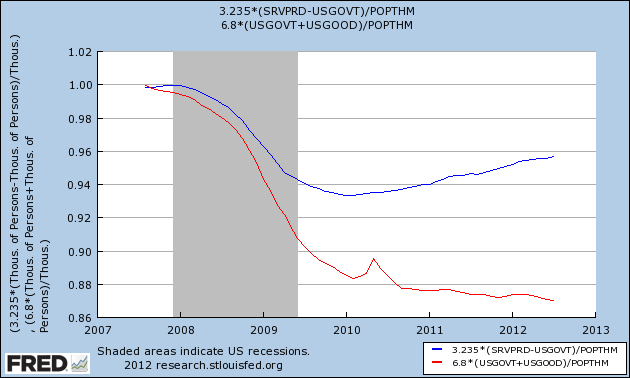

* More logs on the low-wage, service-economy recovery fire, this one from Bonddad: private-sector service-job recovery (blue) has been not great, goods-producing and public-sector recovery (red) is non-existent.

* Part of that public-sector decline: spending on education has declined substantially since 2009.