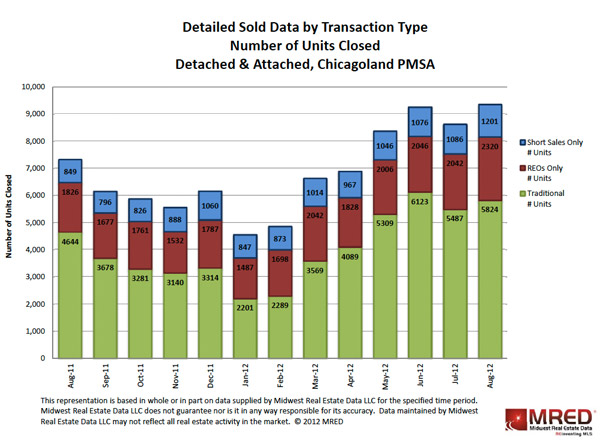

After a few months of declines, sales of Chicago-area homes that were either foreclosed or sold for less than the value of the mortgage increased in both July and August, according to new data out Tuesday from Midwest Real Estate Data (MRED), the multiple listing service. In all, the two types of distressed properties accounted for nearly 38 percent of homes sold locally. That means traditional sales—or sales of homes whose mortgages aren’t in financial distress—were just 62 percent of all sales, down from 66 percent in June.

This means that the downward pull that distressed homes exert on the prices of homes in traditional transactions has increased recently. That shows up in MRED’s data: the average sale price of a nondistressed home went up for four months, and then down for two, the reverse of the path taken by distressed properties.

There is some good news for the sellers of nondistressed homes: MRED’s data show that, in July and August, those residences were taking about 20 days less to sell than they had a year before. They’re also selling for closer to their original asking price, as sellers increasingly catch on to the fact that they have to list the house at today’s price levels, not the inflated ones from several years ago.

The number of traditional homes selling is also getting healthier: the total number of sales in August—5,824—was up 25 percent from August 2011, which had 4,644 sales.

But distressed property sales were up 31 percent in August from a year before, according to the MRED data. (On the chart, distressed properties are the blue and red portions; REO refers to foreclosures, which are “real-estate owned,” or owned by the real-estate division of a mortgage lender.) That month, foreclosures were 24.77 percent of all homes sold in the Chicago area’s nine-county Primary Metropolitan Statistical Area, which MRED serves. That’s up from 23.63 percent in July. Foreclosures’ share of all sales was at 34.83 percent in February, but dropped every month from March through June before rising in July.

Also in August, short sales—homes sold for less than what’s owed on the mortgage—accounted for 12.82 percent of all Chicago-area sales, up slightly from 12.57 percent in July. Short sales accounted for 18.64 percent of local homes sales in January, and then dropped every month from February through June before rising in July.

There is reason to believe that foreclosure sales will increase even more in the future: many more properties are in foreclosure and eventually will be let go for sale by their lenders. Last week, RealtyTrac reported that, in August, Illinois had the nation’s highest rate of foreclosure: 1 in every 298 housing units. That’s more than twice the national rate of 1 in every 681 units. As I said on ABC-7’s early morning news Tuesday, there are three major reasons for the spike in Illinois:

• We are a judicial state (PDF), which means a judge gets involved in every foreclosure. Nonjudicial states such as California and Arizona were faster at clearing the backlogs that built up during the 2011 foreclosure moratorium.

• Our unemployment rate remains higher than the national rate. The longer people fail to find new jobs, the more likely they are to end up losing their homes in foreclosure.

• Intertwined with those two is the fact that our recovery is lagging behind that in other cities. Earlier this month, when CoreLogic reported that home prices in July were up 3.8 percent nationally over prices in July 2011—and that five states had prices more than 7 percent above the 2011 figure—Illinois prices were down 1.7 percent from the prior year.

Just two months ago, I wrote that the Chicago market was seeing a long-overdue uptick. Since that time, prices on local home sales of all types have dropped 5.8 percent, according to MRED, and 3.7 percent on the sales of nondistressed homes. Some of the change may turn out to have been attributable to summer winding down. I’ll keep an eye on future data and post updates below this story in future months.